Empower Your Wellness Journey

Discover tips and insights for a healthier lifestyle.

Marketplace Liquidity Models: Where Demand Meets Supply in Style

Discover innovative liquidity models that blend demand and supply in style—transform your marketplace strategy today!

Understanding Marketplace Liquidity: Key Models Explained

Marketplace liquidity refers to how easily assets can be bought or sold in a market without affecting their price. Understanding the models of liquidity can help investors and businesses navigate various marketplaces more effectively. The two primary models of marketplace liquidity are the order book model and the market maker model. The order book model lists all buy and sell orders for an asset, providing a transparent view of the market at any given time. On the other hand, the market maker model involves intermediaries that facilitate trading by providing liquidity, thus making transactions smoother and faster for buyers and sellers.

Another essential aspect to consider is liquidity depth, which determines how much of an asset can be bought or sold at a given price without causing a significant price change. This concept is crucial as it directly impacts market stability and efficiency. A highly liquid market can absorb large trades with minimal impact on price, while a market with low liquidity can experience dramatic price shifts from relatively small trades. By grasping these key models and concepts, stakeholders can better position themselves in various trading environments and make more informed decisions.

Counter-Strike is a popular first-person shooter game that has captivated millions of players around the world. The game features intense team-based gameplay, where players can choose to be part of either the terrorist or counter-terrorist team. Many players enhance their gaming experience by using skins, and you can find exciting offers like the daddyskins promo code to customize their weapons.

How to Optimize Supply and Demand in Marketplace Liquidity

Optimizing supply and demand in marketplace liquidity requires a strategic blend of data analysis and market understanding. First, it's crucial to monitor real-time data to identify trends that may influence both supply and demand dynamics. This can be accomplished by analyzing key metrics such as pricing fluctuations, inventory levels, and consumer behavior. By utilizing tools like market analytics and visualization software, businesses can gain insights into when to adjust their offerings or pricing structures to achieve a better balance.

Additionally, facilitating effective communication between buyers and sellers is vital for enhancing marketplace liquidity. Implementing features like dynamic pricing, where prices adjust in response to demand changes, can help in maintaining equilibrium. Furthermore, fostering a community through user feedback and engagement not only builds trust but also encourages participation, ultimately stabilizing supply and demand. Employing these strategies can significantly improve marketplace liquidity and drive sustainable growth.

What Factors Influence Marketplace Liquidity and User Experience?

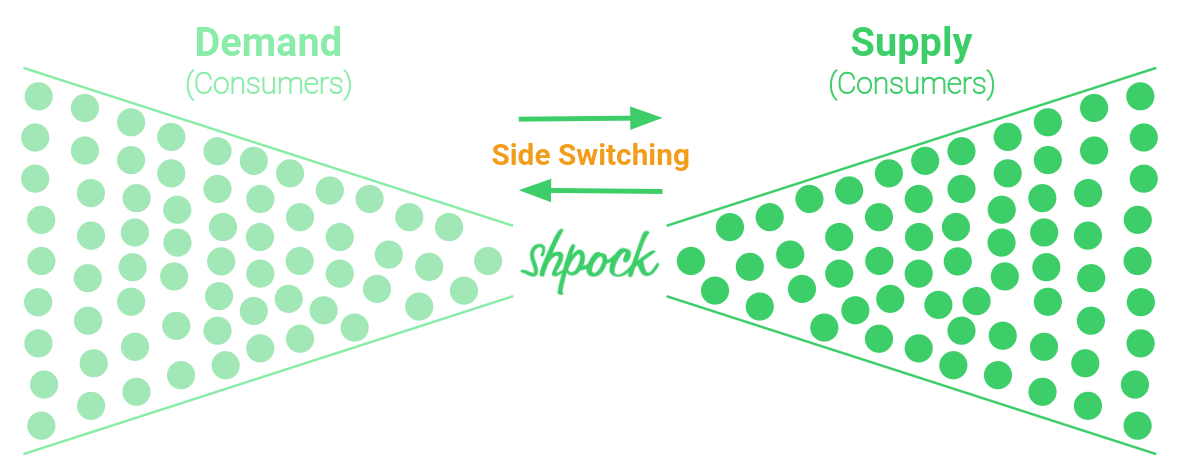

Marketplace liquidity refers to how easily assets can be bought or sold in a marketplace without causing significant price changes. Several factors influence this liquidity, including the number of participants, the volume of transactions, and the diversity of available assets. A larger user base typically contributes to higher liquidity, as more participants lead to more transactions. Additionally, when transactions occur at higher volumes, it can create a sense of stability, attracting even more users. Conversely, a marketplace can suffer from low liquidity if it has a limited range of products or if it is only frequented by a small group of buyers and sellers.

User experience is equally critical in maintaining marketplace liquidity. A well-designed user interface can enhance usability, making it easier for users to navigate the platform and complete transactions. Factors such as loading speed, search functionality, and overall aesthetic greatly affect how satisfied users feel when engaging with a marketplace. Moreover, effective customer support and clear communication can alleviate potential concerns users may have, further encouraging them to buy or sell with confidence. Ultimately, a seamless user experience can lead to increased activity and, consequently, improved liquidity.